does south dakota have sales tax on vehicles

45 South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6. For vehicles that are leased or rented see Lease and Rental Taxation.

South Dakota 1973 License Plate Automobile Vehicle Original Issue Tax Tag Ebay

With local taxes the total sales tax rate is between 4500.

. The South Dakota sales tax and use tax rates are 45. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. South Dakota also does not have a corporate income tax.

South Dakotas taxes on vehicle purchases are applied to the sale price before rebates or incentives. Car sales tax in South Dakota is 4 of the price of the car. The South Dakota sales tax rate is 4 as of 2022 with some cities and counties adding a local.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. When it comes to providing essential public services like public safety transportation and health care South Dakota depends significantly on taxes. South Dakota does not have an individual income tax.

South Dakota municipalities may impose a municipal. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. However the buyer will have.

Several examples of of items that exempt from. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. Do you pay sales tax in South Dakota.

What is South Dakotas Sales Tax Rate. Does South Dakota charge sales tax on cars. South Dakota levies a 4 sales tax rate on the purchase of all.

This includes South Dakotas state sales tax rate of 4000 and Rapid Citys sales tax rate of 2500. South Dakota has a 450 percent state sales tax rate a. Thus a 12000 car may have a 1200 cash rebate.

Its important to note that this does include any local or county sales tax which can go up to 35 for a total sales. All retail transactions such as the sale. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

Counties and cities can charge an additional local sales tax of up to 2 for a. What Rates may Municipalities Impose. In addition to taxes car purchases in South Dakota may be subject to other fees like.

The South Dakota sales. What is the total sales tax rate in South Dakota. All car sales in.

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident Dirt Legal

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

North Dakota Sales Tax Handbook 2022

Are There Any States With No Property Tax In 2022 Free Investor Guide

Sales Taxes In The United States Wikipedia

Sales Tax On Cars And Vehicles In South Dakota

South Dakota Sales Tax Small Business Guide Truic

Cars Trucks Vans South Dakota Department Of Revenue

Sales Taxes In The United States Wikipedia

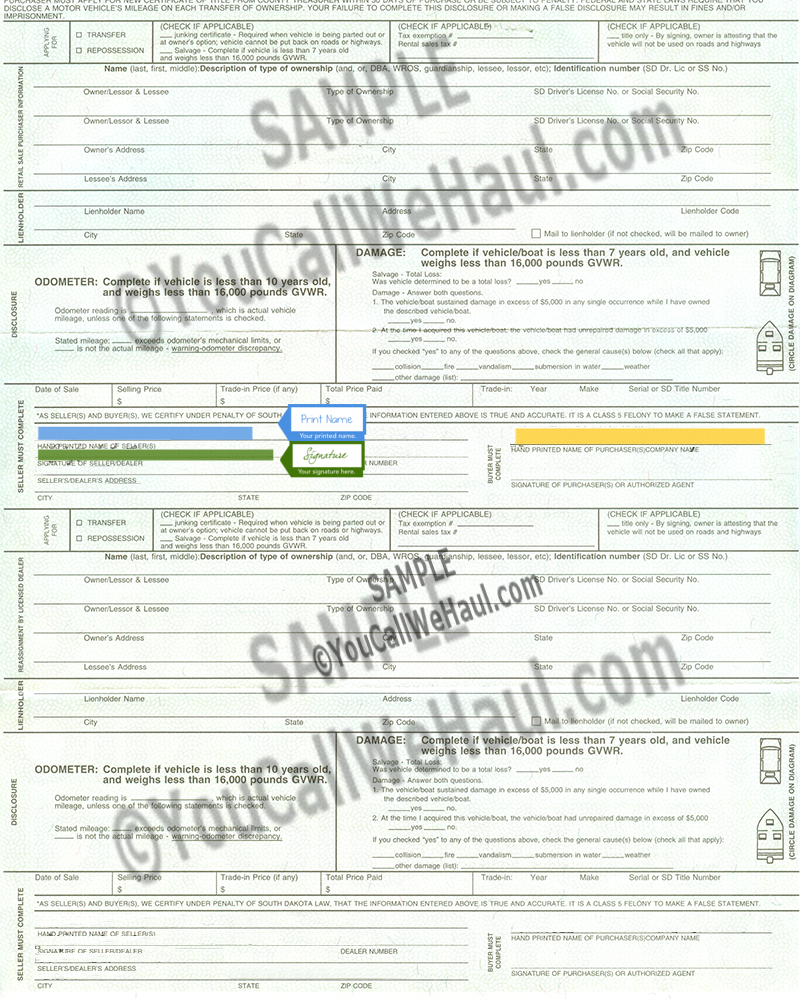

How To Transfer South Dakota Title And Instructions For Filling Out Your Title

How To Register For A Sales Tax Permit Taxjar

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Taxes In The United States Wikipedia

Car Tax By State Usa Manual Car Sales Tax Calculator

Cars Trucks Vans South Dakota Department Of Revenue

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)